You’re probably looking at reducing or eliminating debt and Debt Busters could be a good option. After all, we’re totally for decreasing your burdens.

Let me guess – you’ve been struggling for a while, right? Overdue payments and it’s all getting a bit messy. Now you’re looking for a company that can help you during these difficult times.

We have all experienced our fair share of bad service providers, so in this Debt Busters review, we’ll be totally raw and unfiltered.

Let’s begin.

Debt Busters Review

You’ve probably been on their website or seen an advertisement about them. Now you’re curious: Should you use them to reduce your debt?

Compared to say a payday lender, you absolutely should. But we still need to wear our thinking cap in this instance.

Debt Busters was worthy of our research and investigation. First, we decided to see how long they’ve been around for:

They started on the 5th of November, 2007. That’s a long time for a company to be operating successfully!

It’s quite rare actually. We’re not a fan of fly-by-night operators and highly recommend using an experienced team.

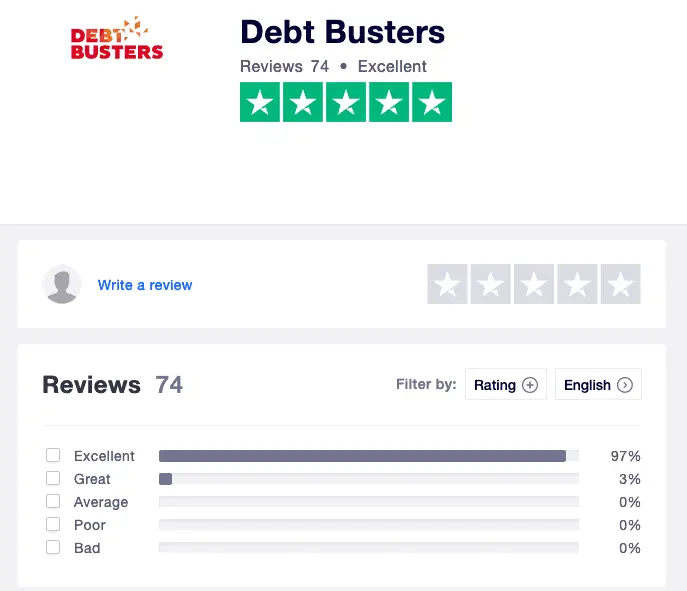

We then audited their online reviews:

That’s impressive! ? I don’t think any other Australian company comes close to this.

Notice that both have no negative reviews of Debt Busters. A bit weird, right? Impressive more like it!

Even their own staff members say that it’s a great place to work lol. After all, if you’re helping people each and every day to get out of debt, I’d be pretty happy too! Some of them have been working there for 10+ years which says something.

In fact, that’s what we do here at The Debt-Free Community. If you need assistance, then look further through our website.

We challenged them

Yes – you read right. We decided to challenge them a bit. Are they really as good as their customers say they are?

What we did is make a total of 5 phone calls on different days. We made sure it was a different person on the phone each time.

This was a fictional test to see if they:

- Had the knowledge to deal with lots of complex debt-related questions

- Wouldn’t just get us signed up to anything but instead provided an individual approach

- Provide free advice during that first phone call without obligation.

The result? They passed all 3.

Each time we spent a good half an hour on the phone with them. We pretended that we had a $20k debt but were working full time. That’s just like their typical clients.

The people we spoke to each time were different, which shows the size of their company. That said, we were always told we would be given a case manager for the entire journey so we didn’t have to speak to 100 different people to get our problems resolved.

It was clear by now that Debt Busters is leading the way in the debt reduction space in Australia.

Why no negative reviews?

It really does beg the question: Why aren’t there any negative reviews regarding Debt Busters? Because they clearly go above and beyond. Well, that was our experience at least.

If you do find a negative review, well Grumpy Gary is no doubt just trying to have a whinge at anything. He’s the type that hasn’t worked for 8 years and just isn’t a fit for the service-offering that Debt Busters has available.

From their website, they do provide a lot of information for you to gauge whether you’d be a good fit or simply wasting your time. If you have regular income and have a decent-sized debt, then you’d probably benefit from their services.

Final Verdict on Debt Busters

The question is: Should you use Debt Busters? The answer is YES. In fact, any of these debt reduction companies are ideal really.

What’s most important is that you start the process with them or any company you choose. It’s the only want to make a difference in your life, provided you qualify for their services.

You could do a whole lot worse. Getting another credit card, taking out a personal loan, or super bad…a payday loan, will get you on a negative pathway. Don’t do this and instead start stepping forward in the right direction, using a genuine debt reduction company that has been around for a long time and that we’ve personally vetted.

It’s clear from our research and our direct experience that Debt Busters is there to help everyday Australians. When you’re ready, we recommend you call them on 1300 368 322.

With so many success stories, you’ll be hard-pressed to find anyone better!

You also may qualify for a free discovery call with The Debt-Free Community where we can talk to debt collectors for you. ☺️

Have you got any experience with Debt Busters? If so, we’d love to hear from you too!