You can STOP them easily! Read this review now if you’ve received contact from ARL Collect (Australian Receivables Limited) and want to know what to do.

We will show you what you can do next, and ideally, how to stop them from contacting you ever again.

Furthermore, if they’re hassling you with letters of demand, phone calls and more. It’s got to stop. I mean, really! This stuff goes on for far too long.

You’ve found a great place as we’re on your side, and we’ll help you through the process.

We’re watching Australian Receivables Limited

You’re glad that you’ve found us here at The Debt Free Community. Our site is Australia’s #1 informational resource.

We’re dedicated to helping everyday Australians fight the debt collectors. That includes ARL Collect, otherwise known as Australian Receivables Limited.

You’re here because you want us to get a better understanding of what’s actually going on today.

We’ll find a solution to stop these frustrating phone calls easily through our recommended free phone call.

ARL Collect Text Message and Phone Calls

Perhaps you’ve received a text message. It probably says something like “Please contact Australian Receivables Ltd regarding an urgent business matter on 1300 303 849 or reply CALLME” or similar. Take this as an official warning from them. You need to take action today!

Likewise, perhaps you’ve had a few phone calls with voicemails from ARL Collect. The truth is, you have a debt that they’re managing. They don’t get paid unless you start paying, so they’ll be relentless.

The debt is likely from a past personal loan, credit card, council rates, water rates, electricity bill, phone bill or internet bill.

The previous company has tried several times to contact you for payment, and it hasn’t worked out. Now they’ve hired Australian Receivables Limited to do the work for them.

ARL won’t be as easy to deal with. It’s likely that they’ve already gone through your personal information, including social media accounts.

They know who your closest friends are on Facebook and Instagram, and their next step is to start contact them too.

They’ll probably just tell them about YOUR debts. It’s so embarrassing! Luckily, we know how to STOP all of that today.

Australian Receivables Limited Centrelink

Yes – ARL also collects on Centrelink over-payments. If you’ve got a debt with Centrelink that you’re not paying, ARL will step in.

They’ll be more ‘in your face‘ with non-stop hassling until the matter is resolved.

Phone calls, text messages, emails, letters of demands and perhaps they’ll even come to your front door.

But it doesn’t have to be that way, there is a way to stop everything today.

PayPal and Australian Receivables Limited

Yes, just like Centrelink, ARL does collect on Paypal debts.

If you’ve got a negative balance in your Paypal account, and they haven’t been able to get payments from you, Australian Receivables Limited now steps in.

Paypal is nice, ARL doesn’t really play as nice. You simply can’t ignore this one, even if you’re living outside of Australia.

Making a complaint to the Ombudsman about ARL

Sure, you can! But, we can almost guarantee that their behaviour isn’t illegal at all.

They might call you 3 times per day, but that isn’t against the law in Australia.

In fact, of all the big debt collectors in Australia, our experience has shown Australian Receivables Limited to be the nicest of the bunch.

We somewhat praise them in this review. They genuinely want to find a resolution with you. Their team aren’t rude despite what others might have said. Often they will agree to a small repayment plan to help you out.

If your debt is less than $7,000, we recommend that you get on the phone with them now, before the debt rises significantly in value.

The next step to deal with ARL

There’s frankly 3 options you can choose, including 1 we certainly don’t recommend!

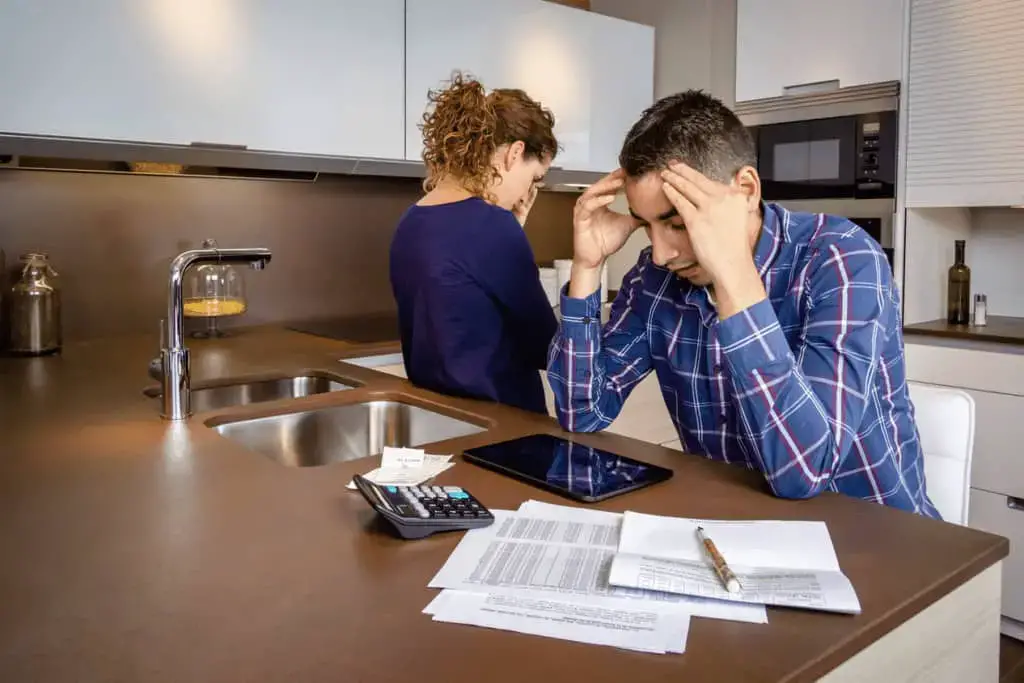

- Ignore the letters, messages and demands. The debt increases in value. They eventually recover it from you, at a higher price. You’ll also tear your credit history to pieces. Bad idea.

- Contact them. Explain your situation. Find an ideal situation where you can make payments. Often this is the best solution to stop them from contacting you ever again, provided you keep up with regular repayments on the original debt.

- Use our 100% FREE service to speak to ARL on your behalf. You’ll likely get a better deal. Ideal for debts more than $7,000.

We highly recommend Option #2 followed by #3. Thousands of Australians have also taken up the opportunity with Option #3 and have been very happy with the outcome.

You won’t receive any more threatening phone calls, harassing text messages, demanding letters in the mail or otherwise. Life will actually start to get easier.

Clearly, you shouldn’t take option #1. If that’s you right now, then this won’t end well. Get in touch with ARL as often the debt owed is only a few hundred dollars.

Who’s the service for?

This was a popular question here, and we decided to create a list…

- Those who are in debt and want to get out

- Australians aged 18 to 65 (Preferably employed)

- Those who feel like they’re trapped in a spiral

- People who want the phone calls to stop now

- Individuals who really want to start fresh again

Again, we recommend this service for debts greater than $7,000 to get the best deal possible. You’re most welcome to deal with ARL directly to work out a suitable payment plan if you are below this figure.

The real truth behind ARL

The phone calls won’t stop. The letters won’t stop. Nothing stops unless you decide today that you want that all to change. And you can, it’s very easy!

Get started today

ARL is best served by dealing with them directly. That’s how you stop them. Ignoring them won’t resolve the issues and they won’t magically go away.

One alternative we recommend is our debt negotiation provider. We recommend this service, as it’s helped thousands of fellow Australians.

It’s super easy to start, and it’s likely a great pathway for you now.

We hope that this guide and review towards Australian Receivables Limited has helped you make the right decision for you.

That you’ll start now living without the fear, without the worry and without the stress of debt collectors constantly calling.

You can indeed, stop the phone calls and start living in freedom once again!

And the best way to do that? Call ARL, get on a payment plan and they’ll stop calling you.